Nutraceutical merchant accounts are a great way for nutraceutical firms to seamlessly accept payments. The accounts enable acceptance of payments from customers in the US and internationally. With access to scores of US and international banks, all payments are covered. Check out our nutraceutical merchant accounts today and get your business finances in good health!

Improve the Health of Your Business Finances

With our nutraceutical merchant accounts, your business enjoys a range of benefits. Although the nutraceutical industry is classified as high risk by traditional banks, we welcome all nutra merchants.

The benefits to your business finance are tangible – and immediate. The inbuilt chargeback prevention within the accounts protects your cashflow and reduces risk. With lower risk of chargebacks, your business finances automatically become more secure and profits increase

The range of online dashboards and reporting are also invaluable in giving you visibility of your finances. With better sight and real time visibility of payments, you can plan cashflow and order volumes efficiently.

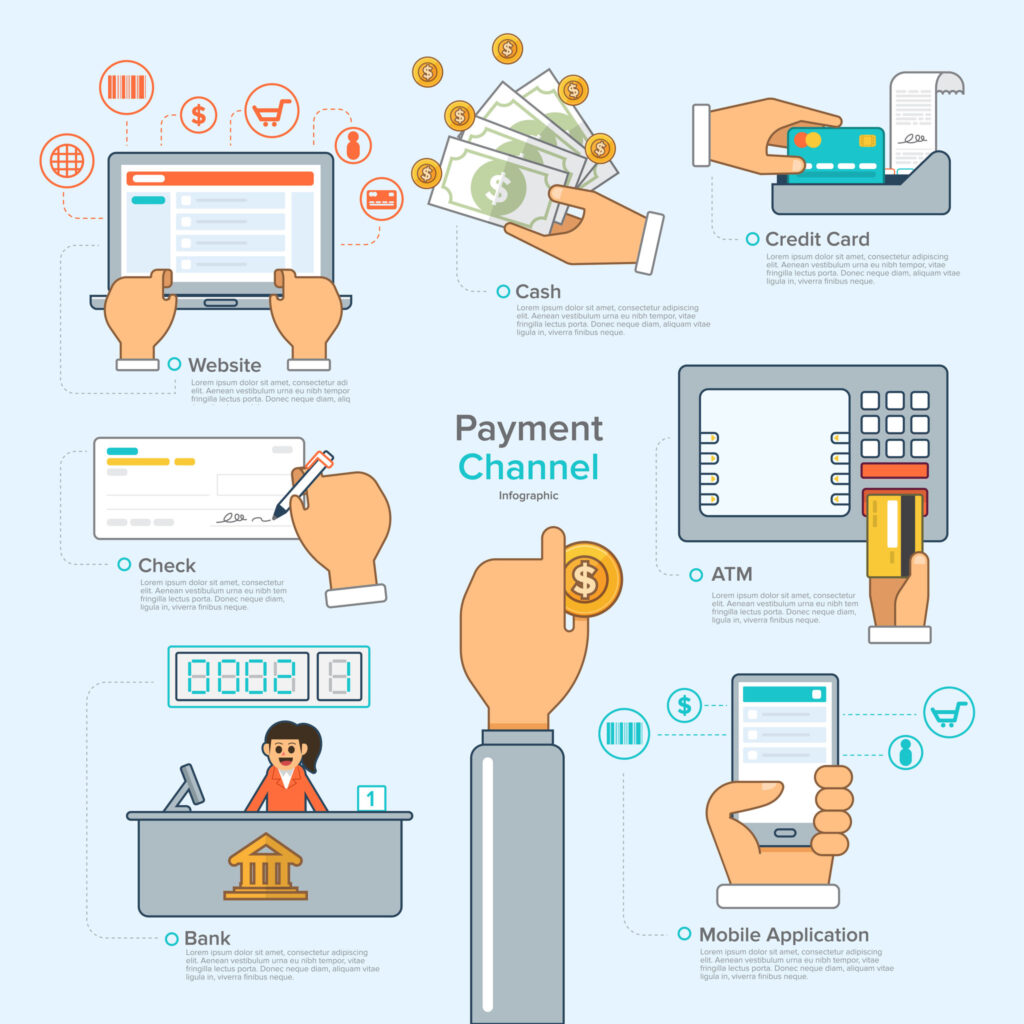

With the accounts, you can setup one-time and recurring payments quickly and easily. You can integrate the payment gateway into your ecommerce store seamlessly. And perhaps best of all, you can offer your customers a wider choice of payment methods. The more choices you can offer, the more sales you are likely to make.

Payment Processing to Match Market Demand for Nutra Products

Business in the nutraceutical industry is thriving – we know that. With 3 in 4 Americans reporting use of dietary supplements and other ways of boosting their lives, your business cannot sit still. And internationally, the wellness industry accounts for over 5% of global GDP.

There are opportunities to sell more and more products to boost energy, appearance, sexual desire, and more. Whether your business sells skin care, weight control, stress reducers or other products, these accounts are the perfect fit.

But the business model is not always a popular one with traditional banks. Many reputable and successful nutraceutical firms suffer from banks labelling them as high risk. This is because the industry is known for high chargeback levels, which can be costly to banks.

Also factored in are the regulatory conditions for the nutraceutical industry, and the risk this represents. Lastly, one time payments are more popular with traditional banks. With many nutraceutical customers paying on regularly recurring payment models, this also increases risk.

To thrive in the nutraceutical industry, your business needs the right payment processing infrastructure in place. Our nutraceutical merchant accounts offer the perfect solution to this.

Keeping Nutra Merchant Accounts Secure

Our nutraceutical merchant accounts also place a premium on security. With growing cyberthreats and more sophisticated hacks on a daily basis, this is a must.

The accounts enable you to enter MOTO payments with secure virtual terminals. You will also benefit from Level 1 PCI-DSS payment gateways. These protect both your business, and your customers’ personal and financial information. Your account can also be customized to detect and handle fraud depending on the nature of your business.

Apply For Our Nutraceutical Merchant Accounts

It is free and easy to apply for our nutraceutical merchant accounts. Each account comes with the processing capacity you need to concentrate fully on sales.

Your initial application and documentation are all submitted online. You are then assigned a account manager to guide you through your account opening.

We keep admin to a minimum. You will be asked to provide standard documentation. This helps our underwriting team understand your business in more detail. Doing so helps the underwriting team to fully vet your application and minimize your risk.

Our US nutraceutical merchant accounts are approved within 3-5 business days. Once approved, your business can accept credit card payments from your customers right away. Apply today for your nutraceutical merchant account today and revitalise your firm’s potential!

Find Out More

Find out more and apply online for our nutraceutical merchant accounts.

Feel free to email info@PaynetSecure.net. Or call 888-5-PAYNET today.